Smart Real Estate Investing: Insights & Strategies

Explore our collection of expert articles, guides, and tips designed to help you navigate the world of real estate investment. From the latest market trends to practical advice on financing and property management, our blog is your go-to resource for building a successful investment portfolio. Stay informed, stay ahead, and make the most of every opportunity.

Recent articles

Your Guide to Successful Real Estate Financing

Explore our curated collection of in-depth articles, expert tips, and actionable insights designed to guide you through every step of your investment journey.

Bridge loans are an essential tool for real estate investors who need quick access to

-

Maximizing Your Real Estate Investments with DSCR Loans

August 9, 2024 -

Real Estate Investment Potential with DSCR Loans

August 4, 2024

Maximizing Your Real Estate Investments with DSCR Loans

Real Estate Investment Potential with DSCR Loans

STRESS-FREE LENDING PROCESS

From Start to Finish

At SubTo Money Hub, we understand that choosing the right financing partner is crucial to your success as a real estate investor. Our commitment to providing personalized service, expert guidance, and flexible loan options sets us apart from the rest. Here’s why you should trust us with your investment journey:

- Tailored Financing Solutions

- Expertise You Can Trust

- Fast and Efficient Process

- Competitive Rates and Terms

- Dedicated Customer Support

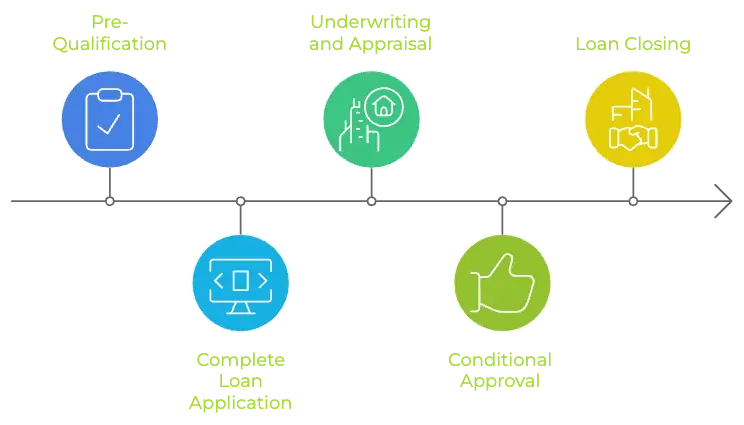

How It Works

The Loan Application Process

From pre-qualification to closing, our streamlined loan process ensures you get the funding you need quickly and efficiently to move forward with your real estate investment.

You ask, we answer

Navigating real estate investments and financing can be complex, but you don’t have to do it alone. Our FAQ section addresses the most common questions about our loan products, the application process, and everything in between. Whether you’re just getting started or looking to expand your portfolio, find the answers you need to move forward with confidence

We lend nationwide in 46 states across the U.S. States we do not lend in include DE, ND, SD, VT. However, other states may be approved by exception.

Private money loans can have several advantages over traditional bank financing including:

- A simpler application process and quicker approval/disapproval decision.

- Less scrutiny of the borrower’s personal financial situation, including income and historical tax returns, compared to bank loans.

- Borrowers can allocate less time to seeking financing and instead concentrate on other businesses.

- Most private money lenders do not expect perfect credit and substantial amounts of disposable income from borrowers, but instead focus on the merits of the specific deal under consideration.

We make lending easy, fast, and efficient. SubTo Money Hub can do the deals that other lenders can’t. Our range of loan programs gives us an edge over our competitors.

We offer flexible financing for investors in residential real estate. Our loan programs include:

Residential Loan Programs:

• Acquisition-Only

• Purchase + Rehab

• Refinance – Rate & Term

• Refinance – Cash Out

• Refinance + Rehab

• Rehab + Rent

• Purchase Bridge Loans

• Refinance Bridge Loans

• New Construction

• Short-Term Rental Loans

• DSCR Long-Term Rental Loans

Advanced rehab draws provide borrowers with instant access to funds, enabling them to initiate their projects without delay. This grants borrowers a significant advantage by helping them maintain their financial fluidity.

SubTo Money Hub provides bridge loans offering short-term funding to cover the gap between two transactions, typically when your construction loan is due, and your long-term financing is complete or additional time is needed to sell the property.

No, we lends only to business entities (LLC’s, C Corps, etc.). Registering a business entity is easier than many think, and the process can often be started online through your state government.

We do not have an owner-occupied loan program. We lend to experienced real estate investors for the purchase, improvement, and construction of residential non-owner-occupied properties, including rentals.

- No Asset Verification

- Residential, Non-Owner Occupied Properties

- Advanced Rehab Draws and No Monthly Payments

- Escrow Payments

- Delayed Purchase Financing

- No Income and No Tax Returns

- Fast In-House Underwriting and Easy Draw Process

- Exceptional Customer Service and Dedicated Account Manager

- Flexible Terms and Competitive Rates

- Construction Funds Paid at Closing

Fill out our online application here to start the conversation. Each loan scenario is unique, and we believe in a personalized approach to each transaction.

Ready to Start?

Fill out the form now!

Take the first step toward securing your investment—fill out our quick and easy application now to get started.