Flexible Capital Solutions for Your Growing Portfolio

Get the financing you need to capitalize on every real estate opportunity, from rehabbing to new construction. Our flexible loan options provide the speed and support to help you grow your portfolio with confidence.

Get the capital you need to enhance your property portfolio

DSCR Loans

Key Features:

Property Types: 1-4 SFH, condos, townhomes

Credit Score: Minimum 660+

DSCR Requirement: .75x minimum

Loan Terms: 30 Year Fixed Rate, ARMs, and Interest-Only

Cashout Options: 75% Cashout Available on All Unleased or Vacant Properties

Rehab Loans

Key Features:

Property Types: 1-4 single-family homes, condos, townhomes

Acquisition LTV: Up to 90%

Rehab Budget LTV: Up to 100%

Monthly Payments: Rolled into the loan to ease cash flow management

Loan Terms: Up to 24-month term available

Ground Up Loans

Key Features:

Property Types: 1-4 single-family homes and townhomes

Loan to Cost (LTC): Up to 90%

Loan to After Repair Value (LTARV): Up to 75%

Loan Terms: 12-24 month terms available

Bridge Loans

Key Features:

Property Types: 1-4 single-family homes, condos, townhomes

Loan to Value (LTV): Up to 80%

No Asset Verification: Streamlined application process with minimal documentation (*restrictions apply)

Loan Terms: 6-24 month terms available

Second Position DSCR Loans

Key Features:

Property Types: 1-4 single-family homes, condos, townhomes

Credit Score: Minimum 680+

DSCR Requirement: 1.1x minimum

Loan Terms: 30-year fixed

Cashout Options: Up to 85% combined loan to value (CLTV) cashout available on unleased or vacant properties

PML

Key Features:

Property Types: 1-4 single-family homes, condos, townhomes

Loan to Cost: Up to 80%

Loan to ARV: Up to 70%

Loan Terms: 6-18 month terms available

Quick Closing Timeline

EMD Lender

Key Features:

Property Types: 1-4 single-family homes, condos, townhomes

Loan Terms Negotiable

Personal Lending

Key Features:

Property Types: Single-family homes, condos, townhomes

Loan to Value (LTV): Up to 85%

Income Verification: Proof of stable income or employment required

Loan Terms: 12-60 months available

Credit Requirements: Minimum credit score of 680

Business Funding

Key Features:

Property Types: Single-family homes, condos, townhomes

Loan Amounts: $100K – $5M

Loan Terms: 12-60 months

Eligibility: Minimum 2 years in business (for acquisition target)

Use of Funds: Business acquisition, working capital, equipment purchases

How It Works

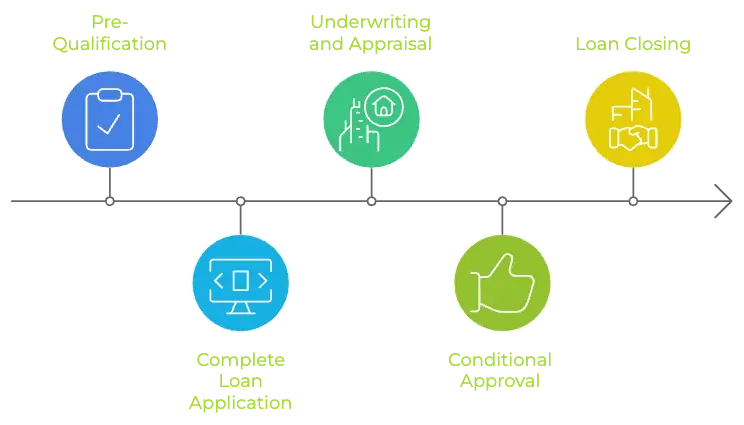

The Loan Application Process

From pre-qualification to closing, our streamlined loan process ensures you get the funding you need quickly and efficiently to move forward with your real estate investment.

Don’t just take our word for it

Adam M

I found a distressed property in a prime location, but I lacked the funds for renovation. SubTo Money Hub for help, and they provided me with a Rehab Loan that covered both the purchase and the renovations.

Karl T

I wanted to expand my rental portfolio and needed a reliable financing option. SubTo Money Hub offered me a DSCR Rental Loan, which enabled me to purchase a new rental property. The loan terms were flexible, and the approval process was fast.

Maria S

I purchased an old, run-down property with the vision of revitalizing it and improving the local community. With a Rehab Loan, I was able to finance extensive renovations.

Michael W

When I came across a prime investment opportunity, I knew I had to act fast. However, my capital was tied up in another property that hadn’t sold yet. SubTo Money Hub came through with a Bridge Loan that gave me the immediate funds I needed.

Don't have a deal yet?

Get Pre-Qualified Today and Start Building Your Investment Strategy with Confidence!

You ask, we answer

Navigating real estate investments and financing can be complex, but you don’t have to do it alone. Our FAQ section addresses the most common questions about our loan products, the application process, and everything in between. Whether you’re just getting started or looking to expand your portfolio, find the answers you need to move forward with confidence

We lend nationwide in 46 states across the U.S. States we do not lend in include DE, ND, SD, VT. However, other states may be approved by exception.

Private money loans can have several advantages over traditional bank financing including:

- A simpler application process and quicker approval/disapproval decision.

- Less scrutiny of the borrower’s personal financial situation, including income and historical tax returns, compared to bank loans.

- Borrowers can allocate less time to seeking financing and instead concentrate on other businesses.

- Most private money lenders do not expect perfect credit and substantial amounts of disposable income from borrowers, but instead focus on the merits of the specific deal under consideration.

We make lending easy, fast, and efficient. SubTo Money Hub can do the deals that other lenders can’t. Our range of loan programs gives us an edge over our competitors.

We offer flexible financing for investors in residential real estate. Our loan programs include:

Residential Loan Programs:

• Acquisition-Only

• Purchase + Rehab

• Refinance – Rate & Term

• Refinance – Cash Out

• Refinance + Rehab

• Rehab + Rent

• Purchase Bridge Loans

• Refinance Bridge Loans

• New Construction

• Short-Term Rental Loans

• DSCR Long-Term Rental Loans

Advanced rehab draws provide borrowers with instant access to funds, enabling them to initiate their projects without delay. This grants borrowers a significant advantage by helping them maintain their financial fluidity.

SubTo Money Hub provides bridge loans offering short-term funding to cover the gap between two transactions, typically when your construction loan is due, and your long-term financing is complete or additional time is needed to sell the property.

No, we lends only to business entities (LLC’s, C Corps, etc.). Registering a business entity is easier than many think, and the process can often be started online through your state government.

We do not have an owner-occupied loan program. We lend to experienced real estate investors for the purchase, improvement, and construction of residential non-owner-occupied properties, including rentals.

- No Asset Verification

- Residential, Non-Owner Occupied Properties

- Advanced Rehab Draws and No Monthly Payments

- Escrow Payments

- Delayed Purchase Financing

- No Income and No Tax Returns

- Fast In-House Underwriting and Easy Draw Process

- Exceptional Customer Service and Dedicated Account Manager

- Flexible Terms and Competitive Rates

- Construction Funds Paid at Closing

Fill out our online application here to start the conversation. Each loan scenario is unique, and we believe in a personalized approach to each transaction.